SUD Life Protect Shield

1314 People reading this blog

1314 People reading this blog

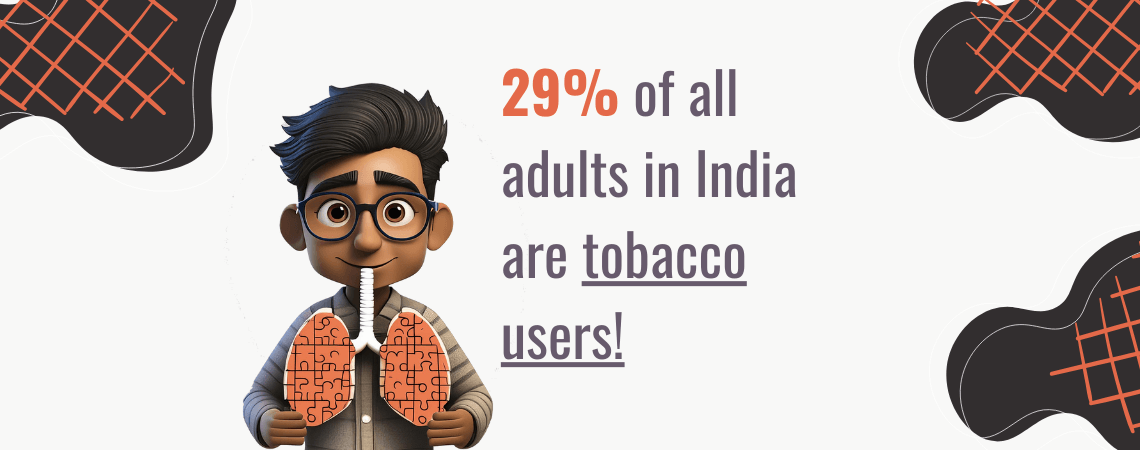

It’s no secret that the number of people who consume tobacco in India, smokeless or not, is exorbitantly high. According to the Global Adult Tobacco Survey India 2016-17, 29% of all adults in India are tobacco users. The actual number? Roughly 26.7 crore people (267 million) above the age of 15.

So, it is a no-brainer that the number of deaths associated with the usage of tobacco is not meagre either. India loses close to 13.5 lakh individuals to excessive tobacco consumption annually alone.

So, when it comes to tobacco use in India, the scene is pretty diverse. Smokeless tobacco is the go-to for many, with folks opting for khaini, gutkha, betel quid (paan) with tobacco, and zarda. On the flip side, we’ve got the smokers, going with bidis, cigarettes, and hookah.

It’s like a ‘tobacco buffet’ out here, with all these various preferences people have. And such data on these habits gives us a real peek into the tobacco culture in the country.

Now we have all heard that smokers/tobacco users tend to live less than people who don’t. Which is something we don’t quite disagree with. There’s a reason chewable tobacco and cigarette boxes come with a disclaimer that they cause cancer, no?

But WHY talk about it here? WHAT has it got to do anything with insurance? The answer is simple – anything to do with life has everything to do with life insurance as well!

Let’s say you go to an insurer tomorrow to get yourself a life cover. The first few things any regular insurer will do is ask you to carry out a full-body checkup and fill up a verification document. And while you’re filling in all the details, there’s one question that comes up more often than not, asking if you’re or have been a smoker.

Here, there could be two instances – one, that you’re a regular smoker and two, that you smoke occasionally. And you might say, “Oh, but I hardly smoke and this question doesn’t really apply to me, so I should simply tick ‘No’”. See, it may seem like the right thing to do at that point, but trust us when we say it’s NOT!

When you talk about life insurance, it’s a bit of a black-and-white situation if you’re a user of tobacco. Whether you’re puffing on cigarettes, cigars, beedis, or even vaping, you’re in the smoker category. And it’s not just about lighting up – if you’re into gutka, pan masala, or even trying to quit with nicotine patches or chewing gums, insurance companies still lump you in with the smokers.

Also, note that life insurance companies don’t care if you smoked the last cigarette a month ago or a week back. But why though?

The fundamentals are pretty straightforward. When you get a life cover for yourself, the insurer covers you based on the risk they have to bear for insuring you. And if you’re a tobacco user, your vitals are a clear answer that your body isn’t functioning the way it should which puts you in the category of a risky individual. And insurers have it very clear with the term ‘risk’. The riskier of an individual you are, your life insurance tends to get pricier. Why would someone who is expected to live until the age of 70 years pay the same premium as compared to someone who is barely going to make it to 65?

How much is the difference in life insurance premiums if you’re a smoker?

Smoking for a long time can up your risk for serious health issues like cancer, respiratory problems, stroke, and heart conditions. So, to make up for this risk, insurance companies charge higher premiums for life insurance policies. It’s their way of dealing with the higher chances of health problems linked to smoking.

Too complex?

Meet Raghav, a 30-year-old health enthusiast and health influencer from Mumbai. Raghav is all about maintaining a healthy lifestyle (at least, that’s what we know) – he eats well, exercises regularly, and stays away from alcohol and tobacco products.

Now, let’s talk about Raghav’s friend, Nitin, who’s also 30 but has a different habit. Nitin has been a heavy smoker for the last few years. When Nitin decided to get a term life insurance policy, the insurance company quoted him an annual premium of Rs. 11,500 for a sum assured of Rs. 1 crore.

On the other hand, Raghav, with his healthy lifestyle and no nicotine consumption, managed to secure the same sum assured of Rs. 1 crore but at an annual premium of just Rs. 8,000. It’s a simple example that shows how lifestyle choices, like smoking, can really impact the cost of life insurance.

In ideal instances, the difference in life insurance premiums racks up to somewhere around a good 30%.

Don’t act smart and lie in your application form!

You remember we said not to tick the box if you have been a smoker or a tobacco user in any capacity? Here’s where it can rock your boats if you’re sailing in two of them!

Say you lied on your form and got away with it under the nose of the insurer while getting a decent life insurance policy, but in the event, something happens to you which can be attributed to smoking or tobacco consumption, the insurer has the right to reject the claim. Why, you ask? For not disclosing a key piece of information when you were clearly asked to!

When a beneficiary raises a claim request, the insurer does a thorough check on understanding the cause of the demise and verifies it to finally settle the claim. Now imagine that one stupid decision that can possibly leave your dependents devoid of the cover amount that you paid the premiums for all these years. Salty, right?

QUIT IT!

Now you have one more reason to quit smoking and using tobacco. So, you’re saying goodbye to smoking, right? Great first step! After steering clear of cigarettes for a bit, you can go to your insurer and apply for a new insurance policy as a non-smoker. But, just a heads up, you would have aged a bit and may/may not have developed a few health complications. Then the insurance team will do a fresh checkup, just to keep things up and running as usual.

You see, quitting won’t magically make your premiums die down tomorrow. But, here’s the cool part – you’ll live longer than you were initially going to!

So, by kicking the smoking habit, you not only save on insurance costs but also set off on a journey to a healthier you. It’s like hitting the health jackpot, with a little extra money in your pocket. Who knew quitting could be such a win-win?

Disclaimer

Star Union Dai-ichi Life Insurance Company Limited

IRDAI Regn. No: 142 | CIN: U66010MH2007PLC174472

Registered Office: 11th Floor, Vishwaroop I.T. Park, Plot No. 34, 35 & 38, Sector 30A of IIP, Vashi, Navi Mumbai – 400 703 | Contact No: +91 22 7196 6200 | 1800 266 8833 (Toll Free) | Timing: 9:00 am – 7:00 pm (Mon – Sat)| Email ID: customercare@sudlife.in | Visit: www.sudlife.in | For more details on risk factors, terms and conditions, please refer to the sales brochure carefully, before concluding the sale. |Trade-logo displayed belongs to M/s Bank of India, M/s Union Bank of India and M/s Dai-ichi Life International Holdings LLC and are being used by Star Union Dai-ichi Life Insurance Co. Ltd. under license.

BEWARE OF SPURIOUS/FRAUD PHONE CALLS:

IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint